HOW DOES A BUILDER GET PAID with A CONSTRUCTION TO PERMANENT LOAN

/When you close on a Construction to Permanent Loan your down payment along the Lender’s funds are used to pay the seller of the lot, or payoff any liens you may have on the lot at time of settlement. Additional funds maybe disbursed to your builder to satisfy any upfront deposit requirements established in your construction contract.

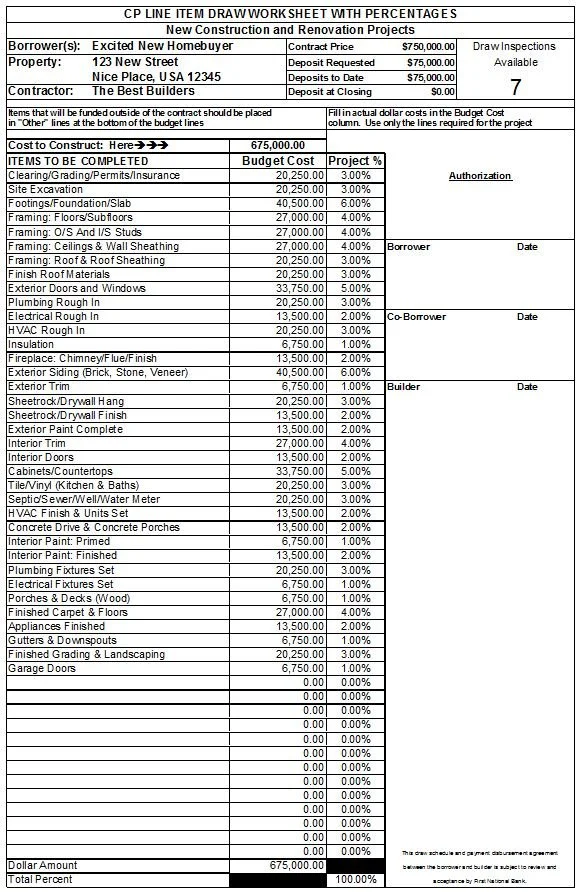

Photo provided by Bay to Beach Builders